B. Business Income

B. Business IncomeThe net incomes in the economy accrue to labor in wages, to landowners in ground rents (both wages and ground rents being “rents,” i.e., unit-prices of productive factors), to capitalists in interest—all of which continue in the ERE—and profits and losses to entrepreneurs, which do not. (Ground rents are capitalized in the capital value of land, which therefore earns the interest rate in the ERE.) But what of the owners? Are their incomes exhausted by the category of entrepreneurial profit and loss, which we have studied in chapter 8, or will they continue to earn income beyond interest in the ERE?

So far we have seen that owners of businesses perform an entrepreneurial function: the function of uncertainty-bearing in an ever-changing world. Owners are also capitalists, who advance present funds to labor and land factors and earn interest. They may also be their own managers; in that case, they earn an implicit wage of management, since they are performing work which could also be performed by employees.49 We have seen that, catallactically, labor is the personal energy of nonowners in production, and that this factor receives wages. When the owner does laboring work himself, then he too earns an implicit wage. This wage, of course, continues also in the ERE.

But is there a function which owning businessmen perform, and would still perform in the ERE, beyond the advancing of capital or possible managerial work? The answer is that they do execute another function for which they cannot hire other factors. It goes beyond the simple capital-advancing function, and it still continues in the ERE. For want of a better term, it may be called the decision-making function, or the ownership function. Hired managers may successfully direct production or choose production processes. But the ultimate responsibility and control of production rests inevitably with the owner, with the businessman whose property the product is until it is sold. It is the owners who make the decision concerning how much capital to invest and in what particular processes. And particularly, it is the owners who must choose the managers. The ultimate decisions concerning the use of their property and the choice of the men to manage it must therefore be made by the owners and by no one else. It is a function necessary to production, and one that continues in the ERE, since even in the ERE there are skills needed to hire proper managers and invest in the most efficient processes; and even though these skills remain constant, the efficiency with which they are performed will differ from one firm to another, and differing returns will be received accordingly.50

The decision-making factor is necessarily specific to each firm. We cannot call what it earns a wage because it can never be hired, and thus it does not earn an implicit wage. We may therefore call the income of this factor, the “rent of decision-making ability.”51 It is clear that this rent will be equal to the factor’s DMVP, the amount which it specifically contributes to the firm’s revenue. Since this ability differs from one owner to the next, the rents will differ accordingly. This difference accounts for the phenomena of “high-cost” and “low-cost” firms in any industry and indicates that differences in efficiency among firms are not solely functions of ephemeral uncertainty, but would persist even in the ERE.

Granting that the “supramarginal” (i.e., the lower-cost) firms in an industry are earning rents of decision-making ability for their owners, what of the “marginal” firms in the industry, the “high-cost” firms just barely in business? Are their owners earning rents of decision-making ability? Many economists have believed that these marginal firms earn no such income, just as they have believed that the marginal land earns zero rent. We have seen, however, that the marginal land earns some rent, even if “close to” zero. Similarly, the marginal firm earns some rent of decision-making ability. We can never say quantitatively how much it will be, only that it will be less than the corresponding “decision rents” of the supramarginal firms.

The belief that marginal firms earn no decision rents whatever seems to stem from two errors: (1) the assumption of mathematical continuity, so that successive points blend together; and (2) the assumption that “rent” is basically differential and therefore that the most inferior working land or firm must earn zero to establish the differential. We have seen, however, that rents are “absolute”—the earnings and marginal value products of factors. There is no necessity, therefore, for the poorest factor to earn zero, as we can see when we realize that wages are a subdivision of rents and that there is clearly no one making a zero wage. And so neither does the marginal firm earn a decision rent of zero.

That the decision rent earned by the marginal firm must be positive and not zero becomes evident if we consider a firm whose decision rent is only zero. Its owner would then be performing certain functions—making and bearing responsibility for ultimate decisions about his property and choosing the top managers—and yet receiving no return. And this in the ERE, where it cannot be simply the unforeseen result of entrepreneurial mistakes! But there will be no reason for the owner to continue performing these functions without a return. He will not continue to earn what is psychically a negative return, for while he remained in business he would continue to expend energy in ownership while receiving nothing in return.

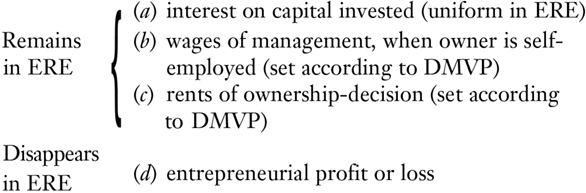

To sum up, the income accruing to a business owner, in a changing economy, will be a composite of four elements:

We have, so far, been dealing almost exclusively with capitalist-entrepreneurs. Since the entrepreneur is the actor in relation to natural uncertainty, the capital investor, who hires and makes advances to other factors, plays a peculiarly important entrepreneurial role. Making decisions concerning how much and where to invest, he is the driving force of the modern economy. Laborers are also entrepreneurs in the sense of predicting demand in the markets for labor and choosing to enter certain markets accordingly. Someone who emigrates from one country to another in expectation of a higher wage is in this sense an entrepreneur and may obtain a monetary profit or loss from his move. One important distinction between capitalist-entrepreneurs and laborer-entrepreneurs is that only the former may suffer negative incomes in production. Even if a laborer emigrates to a nation where pay turns out to be lower than expected, he absorbs only a differential, or “opportunity,” loss from what he might have earned elsewhere. But he still earns a positive wage in production. Even in the unlikely event of a labor surplus vis-à-vis land, the laborer earns zero and not negative wages. But the capitalist-entrepreneur, the man who hires the other factors, can and does incur actual monetary losses from his entrepreneurial effort.

- 49This implicit wage will equal the DMVP of the owner’s managerial services, which will tend to equal the “opportunity wage forgone” that he could be earning as a manager elsewhere.

- 50In one of those extremely fertile but neglected hints of his, Böhm-Bawerk wrote:

But even where he [the businessman] does not personally take part in the carrying out of the production, he yet contributes a certain amount of personal trouble in the shape of intellectual superintendence—say, in planning the business, or, at the least, in the act of will by which he devotes his means of production to a definite undertaking. (Böhm-Bawerk, Capital and Interest, p. 8) - 51For an interesting contribution to the theory of business income, though not coinciding with the one presented here, see Harrod, “Theory of Profit” in Economic Essays, pp. 190–95. Also see Friedman, “Survey of the Empirical Evidence on Economies of Scale: Comment.”