A common criticism of the market economy is that the wealth it generates brings with it unacceptable levels of income inequality—it is conceded that the market economy generates great deals of material wealth, but it is argued that this material wealth is accrued unevenly.

The astute reader will note that income inequality, as measured by the Gini coefficient (one of economists’ favorite measures of inequality), has increased over the last several decades, indeed, the income distribution is almost 16% more unequal than it was in the late 1960’s.

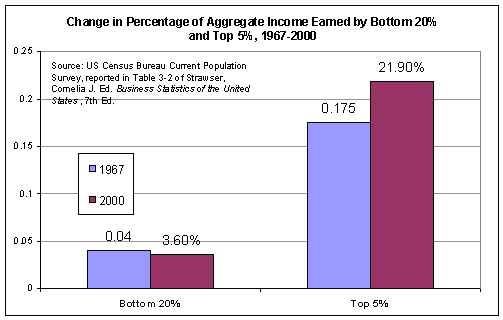

The increases in inequality are apparent when we consider the fact that the share of income going to the bottom 20% of the income distribution has fallen from 4% to 3.6% from 1967 to 2000 while the share of income going to the top 5% of the income distribution has increased from 17.5% to 21.9% over the same period.

This has led a number of people to conclude that the rich are getting richer while the poor are getting poorer. In a recent essay,1 MIT Professor Paul Krugman lamented these increases in inequality and the presumed resultant gulf between the have-a-littles and the have-a-whole-lot-mores. Income inequality is invariably a hot-button political issue; in fact, a group calling themselves “Billionaires for Bush (Or Gore)” lampooned the major party candidates for their supposed toadyism to the moneyed elite with the slogan “inequality is not growing fast enough!” during the 2000 elections.

However, in spite of what income statistics report, it may not be the case that “inequality is not growing fast enough” to please those who may get their jollies from massive interpersonal gaps in ability to consume; in fact, it may not be the case that inequality is growing at all.

First, reported Gini coefficients generally measure pre-tax income rather than after-tax consumption, which means that it systematically overstates the degree of income inequality. Once we consider taxes and transfer payments (”welfare”), it becomes apparent that while the distribution of income may be unequal, the distribution of actual consumption is more equal than press releases and pundits would have us believe.

Second, people often define “inequality” the way the Supreme Court defines pornography—as Justice Potter Stewart wrote in Jacobellis v. Ohio (1964), “I can’t define pornography, but I know it when I see it.” In the same way, many people can’t offer a precise definition of “inequality,” but they presume to know it when they see it. “Equality” in the sense that each and every individual is equal at every margin necessarily means a world that, to quote Murray Rothbard, “would necessarily be a world of horror fiction—a world of faceless and identical creatures, devoid of all individuality, variety, or special creativity.”2

Kurt Vonnegut’s Harrison Bergeron comes immediately to mind. Rather than demand equality at every margin, however, most egalitarians choose to define equality according to one’s income—two people are said to be equal if they have the same money income, and they are said to grow progressively unequal as their money incomes diverge. However, as two recent essays by Washington University economist John Nye3 point out, “our understanding of the rich and the poor has been skewed by what we choose to measure.”

Specifically, our measurements of income and income inequality don’t account for the true differences, or lack thereof, between the sets of goods that the rich and the poor are able to consume. While income figures suggest that the gap between the rich and the poor is expanding, these figures may be misleading. I argue that it is best to think of “inequality” in terms of our ability to substitute the goods available to the poor for the goods available to the rich.

Before we can proceed I must define what is meant by a “good” and how, exactly, examining substitutability sheds insight on the character of inequality. In his classic Theory of Value4 , Nobel laureate Gerard Debreu argues that we can define commodities and goods according to their physical, temporal, and spatial characteristics—this offers us the “what, when, and where” of the theory of goods. This theory is incomplete; to it we must add the definition proposed by Carl Menger, father of the Austrian school. Menger writes that, in order for a thing to be a “good,” it must meet four simultaneous conditions:

The thing must fulfill a human need.

It must have properties that would render it capable of being brought into a causal connection with the satisfaction of the need (or, as Debreu writes, it must have suitable physical, temporal, and spatial characteristics).

We must recognize this causal connection.

There must be command of the thing sufficient to direct it to the satisfaction of the need.5

While the sets of goods available to the rich and poor used to be worlds apart, the physical characteristics of the goods that the poor consume today differ only slightly from the physical characteristics of the goods that the rich consume; in other words, the goods that a poor man consumes would, in many cases, constitute suitable means for the attainment of a rich man’s ends. The goods available to the poor are highly substitutable for the goods available to the rich.

Consider, for example, tickets to a professional hockey game—the difference between the good consumed by blue-collar workers (and economics graduate students) in the rafters and corporate bigwigs in the front row is negligible.6 Or consider a car trip between St. Louis and Kansas City: while the ride may be more comfortable in an SUV with all the bells and whistles, the trip can still be made (usually) in a beat-up ‘87 Chevy Cavalier.

The fundamental want that people wish to satisfy in this case—namely, a trip to Kansas City—can be satisfied with the goods available to the poor just as easily as it can be satisfied with the goods available to the rich. As we will see momentarily, this is a sharp departure from the historical norm.

In addition, the nutritional content available to rich and poor has converged drastically. As the chart below shows, food-stamp-eligible and low-income Americans (defined as those in the bottom 20% of the income distribution) consumed, on average, more than the recommended daily allowance of many nutrients, and their average daily consumption of almost all of these nutrients was within a few percentage points of the average daily consumption available to upper-middle-income Americans (defined as those in the upper 50% of the income distribution).

When we consider actual consumption of substitutable goods, we see that the world is a far more equitable place than the income distribution indicates.

Average Nutrient Consumption as Percentage of 1980 Recommended Dietary Standards

| Food Stamp eligible | Low-income | Upper-middle income | |

Protein | 169% | 156% | 168% | |

Calcium | 89% | 79% | 89% | |

Magnesium | 87% | 78% | 86% | |

Vitamin A | 124% | 144% | 129% | |

Riboflavin | 135% | 130% | 133% | |

Vitamin B12 | 142% | 178% | 171% | |

Vitamin C | 137% | 134% | 156% | |

Iron | 99% | 100% | 101% |

This hasn’t always been so. History shows us that the differences between the types of goods available to rich and poor today differ only in degree, whereas in previous generations, they differed in kind. Nye illustrates this principle by asking us to consider transportation:

The fact of the matter is that for the average citizen of the United States today, compared to the average 18th century European, no differences in quality between the finest car that could be ordered and driven by the rich today and the modest family sedan could begin to approach the differences between the average transportation available to an elite that rode in cushioned carriages while the bulk of the people slogged through the mud and grime for most of their lives.

Nowhere is this convergence more apparent than at the grocery store and in restaurants. For virtually every high-end item, be it a fine cut of meat, specialty spaghetti sauce, whole-grain bread, fresh-ground coffee, or fine liquor, there is invariably a cheaper substitute with almost identical physical, temporal, and spatial characteristics. The list of high-end goods for which we can find cheaper substitutes of virtually identical quality is endless; and the common man of today enjoys fineries of which the most powerful kings of yesteryear couldn’t dream.

As Nye writes, the menu for a lavish, mid-19th century American feast would greatly resemble today’s average $7.99 all-you-can-eat buffet with several important exceptions: higher quality (”more and better breads and fresher fruit and vegetables year round”), greater variety, and “superior standards of hygiene in preparation and service.” And progress in this direction has proceeded with blinding rapidity.

Even this author is old enough to remember when shrimp, without which no cheap buffet is truly complete, was a premium item at most of the restaurants his family frequented in the 1980’s and early 1990’s. As Nye writes, while the relative price gap may be increasing, the relative “quality differential might actually be shrinking.” Quoting Nye again,

Compared to the fact that blue-collar workers can have such food today on a regular basis without much effort, is it really so much better for the rich to be able to afford $200 a plate dinners or $400 bottles of wine? But if we judge inequality by what people can afford we will be blind to the fact that most of what ordinary people want to eat can be had for trifling sums.

In sum, we can argue compellingly that the measures of inequality on which analysts, policymakers, and armchair pundits typically lean may be misleading. Even when measures of real income tell us otherwise, the real differences in income and wealth generated by the free market may be much smaller today than they were 100, 50, and even 10 years ago. So maybe “inequality isn’t growing fast enough” for some — it doesn’t appear to be growing at all.

- 1Krugman, Paul. “For Richer.” The New York Times Magazine. October 20, 2002.

- 2Rothbard, Murray N. 2000. Egalitarianism as a Revolt Against Nature and Other Essays. Auburn, Ala.: Ludwig von Mises Institute.

- 3Nye, John V.C. Economic Growth and True Inequality. January 28, 2002 (available at www.econlib.org/library/columns/nyegrowth.html) and Irreducible Inequality April 1, 2002 (available at www.econlib.org/library/columns/nyepositional.html).

- 4Debreu, Gerard. 1959. Theory of Value. New Haven: Yale University Press.

- 5Largely quoted from Ekelund, Robert B. and Robert F. Hebert, 1997. A History of Economic Theory and Method, 4th ed. New York: McGraw-Hill, p. 293. “Command sufficient” may be interpreted in two ways: first, goods must be owned, which is to say that someone has the right to exclude others from use of the good; second, there must be a sufficient quantity of the good to accomplish a given end. Try as one might, it is impossible to fill a five-gallon bucket with three gallons of water.

- 6See Nye’s essay on positional goods for a thorough discussion of the fact that irrespective of the mode of distribution of income, the good seats at hockey games (like reservations at the world’s finest restaurants) are generally only going to go to those who are willing and able to pay the most for them—those at the top of the income distribution. It may also be argued that the hockey game owes its very existence to those at the top of the income distribution.