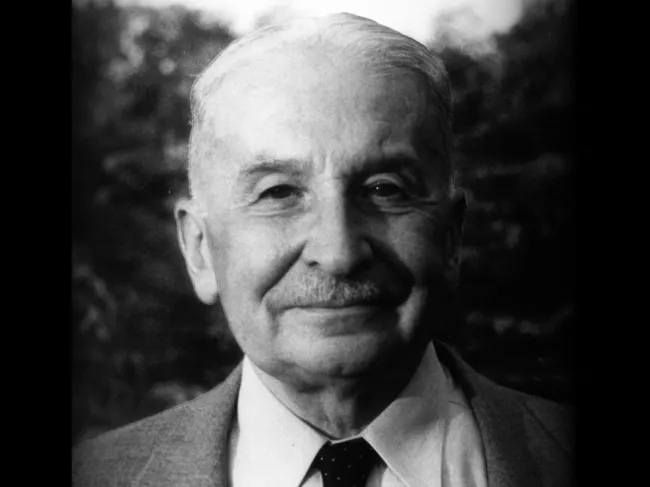

The following interview of Ludwig von Mises was conducted in Lima, Peru, by La Prensa and published on January 4, 1950. Thanks to Cesar Usquiano for this translation.

During his stay in Peru, Professor Mises made some statements that we will see below.

Our first question, in the interview Mr. Ludwig von Mises gave us yesterday, referred to the suspension of Exchange Control, established in the country by Decree Law No. 11208.

I believe, said Professor Von Mises, that the abolition of exchange controls is the best thing that Peru has been able to do to create the conditions to develop and develop its economic activities and, above all, to increase its production. This measure has been, in my opinion, very wise and, as far as I have been informed, its fruits are being felt.

Have you had the opportunity to study the economic conditions in Peru?

I have come to study them and my first impression cannot be better. I see that Peru is a country that is advancing towards the solution of its most difficult economic problems. I believe that my stay in this beautiful city will be very profitable for my research and studies.

But … specifically more, Mr. Von Mises.

Comparatively, Peru is on the same footing as its brothers in America. Neither better nor worse. Simply the same. It seems to me that there is nothing that, for the moment, can be cause for alarm. There are, on the other hand, possibilities in this country that are not available elsewhere. I am sincerely inclined to believe that Peru will be one of the first to overcome its current crisis.

And what can you tell us about the US economy?

Unless there is a national catastrophe, i.e., a war or something of similar projections, the United States will continue to be the most powerful country in the world for a long time to come. At present the economic problems of the Union are not of tremendous proportions by any means. I am confident that before long the American economy will be in a position to assist the resurgence of the rest of the world more effectively than it has hitherto.

And what is your opinion of the current European economy, Mr. Von Mises?

It is in the process of recovery. Much is being done in this regard, but even more remains to be done. The Old Continent has been almost completely devastated and it will be very difficult for it to stand on its own feet in the short term. However, the help that the Marshall Plan is providing to Europe at present is of inestimable value, since, without it, it would not have been possible to begin even the great work of restoration in which the Europeans are engaged. On the other hand—adds our interviewee—the increasingly active trade, as well as the industrialization of the whole territory, have contributed notably to create the climate of prosperity that can be observed in Europe at the present time. All this, of course, outside the Russian orbit.

What about the Marshall Plan and its application to Latin America?

It is undeniable that the Marshall Plan has not yet been put into practice in this part of the continent. The budget, the money available, unfortunately does not allow for more. Most of the funds have been earmarked for the total recovery of Europe, which does not mean that the so-called “less developed countries” have been left aside, but rather that they have been postponed for this time because of urgent European needs.

Do you think that the Marshall Plan will certainly be implemented in Latin America?

There is no doubt about that. What I do find a little difficult is that the Plan can be implemented in all its aspects at least two years from now. It is essential to start laying the foundations of the country’s future economy now. The activity of the entire nation must be fundamentally aimed at producing more and more.

In a special way, the large-scale industrialization of national products should be encouraged. The transformation of products must deserve the same dedication that is given to the extractive and cultivation industries. On the other hand, trade, as an elemental factor of economic improvement, must be strengthened immediately if we really want to balance the budget balance.

And, for now, how can currency stabilization be achieved?

Monetary stabilization always requires a certain amount of time for the rules aimed at achieving it to become fully effective. There is no system that can stabilize the currency from one moment to the next in a country in crisis. For the time being, your immediate recourse is to increase production and strengthen trade. The fundamentals, as I have already said, have been fulfilled by Peru. The free exchange regime will have to give rise to healthy reactions which, in part, are already being felt.

And won’t the International Monetary Fund achieve currency stabilization in these countries?

I think it is wiser not to refer to the International Monetary Fund, since its intervention in the economy in recent times has been almost nil. Notwithstanding the Fund, all countries are suffering from the depreciation of their currencies: they are all experiencing the consequences of inflation caused by the extraordinary expenses incurred during the war that has ended.