Legendary investor Jim Rogers has advocated buying farmland and agricultural commodities for years, but a recent Reuters article discusses the current struggles faced by farmers in a time of high rents and falling commodity prices.

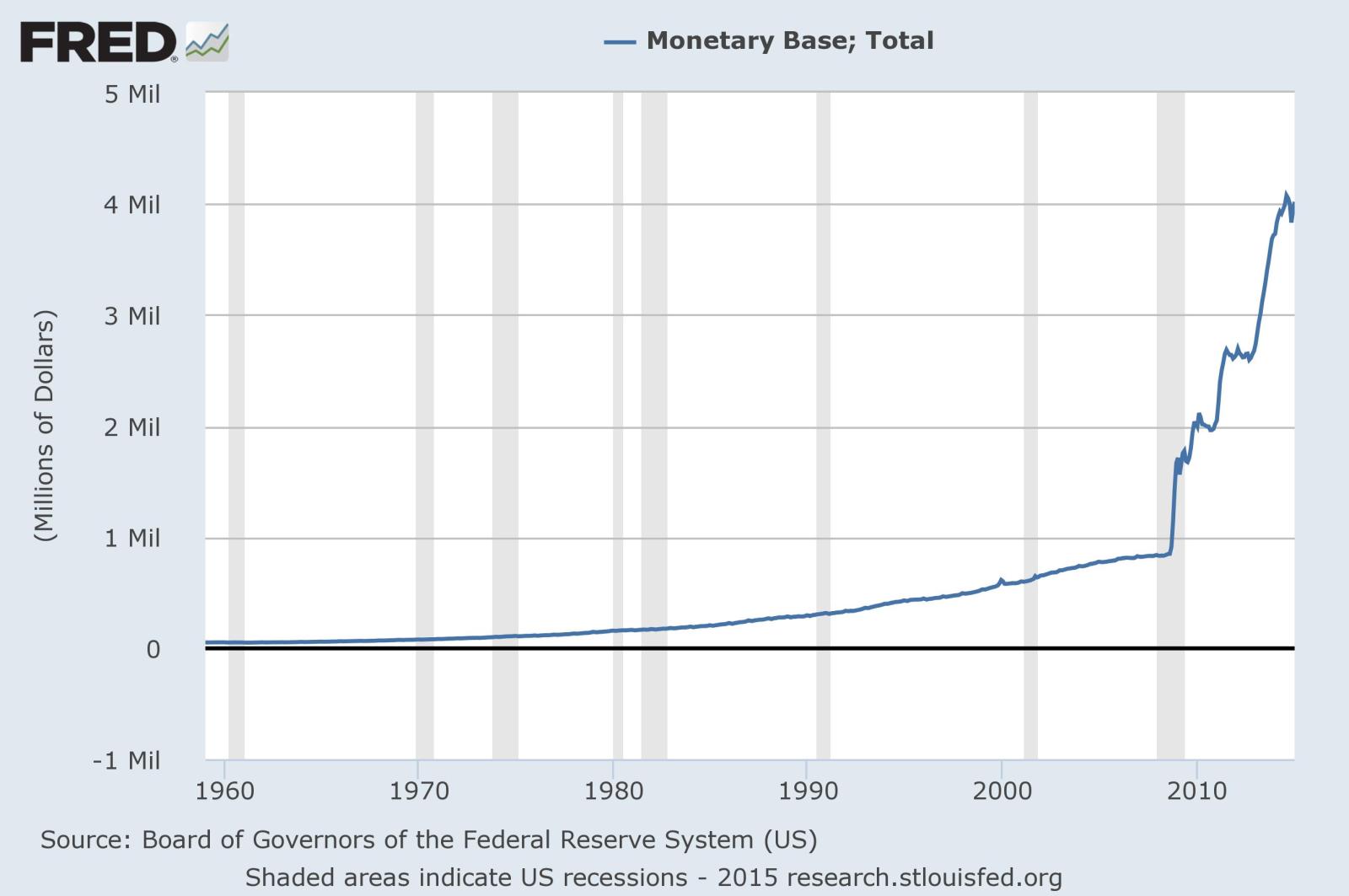

Apparently 7 years of relentless expansion of the monetary base (quadrupled, as shown below) is not sufficient to create liquidity for the agricultural sector, even as Wall Street and Silicon Valley are awash in cash. At what point do the demand-side stimulus voices admit that Fed monetary expansion finds its way into the economy unevenly across time and asset classes?

Concern about broken leases has some landlords reviewing legal options, according to Roger A. McEowen, director of the Iowa State University Center for Agricultural Law and Taxation. His staff began fielding phone calls from nervous landowners last autumn.

One catch is that many landlords never thought to file the paperwork to put a lien on their tenants’ assets. That means landowners “can’t go grab anything off the farm if the tenant doesn’t pay,” McEowen said. “It also means that they’re going to be behind the bank.”

Still, farmers could have a tough time walking away from their leases, said Kelvin Leibold, a farm management specialist at Iowa State University extension.

“People want their money. They want to get paid. I expect we will see some cases going to court over this,” he added.

To avoid such a scenario, farmers have begun turning to banks for loans that will help fund operations and conserve their cash. Operating loans for farmers jumped 37 percent in the fourth quarter of 2014 over a year ago to $54 billion, according to survey-based estimates in the Kansas City Federal Reserve bank’s latest Agricultural Finance Databook.

Loans with an undefined purpose -- which might be used for rents, according to the bank’s assistant vice-president Nathan Kauffman -- nearly doubled in the fourth quarter of 2014 from a year earlier to $25 billion.

Total non-real estate farm loan volumes jumped more than 50 percent for the quarter, to $112 billion.

“It’s all about working capital and bankers are stressing working capital,” said Sam Miller, managing director of agricultural banking at BMO Harris Bank. “Liquidity has tightened up considerably in the last year.”