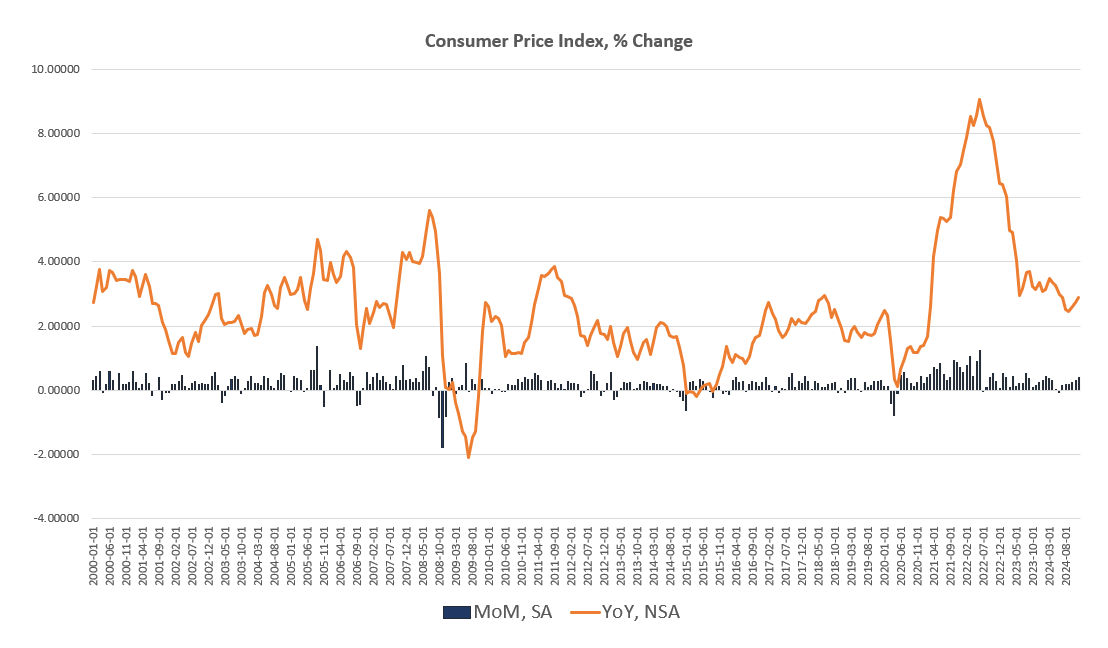

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in December accelerated while the month-to month increase hit a multi-month high.

The seasonally adjusted Consumer Price Index (CPI) rose 0.39 percent, month over month, in December, rising to a ten-month high. Year over year, the CPI rose 2.88 percent in December, not seasonally adjusted. That’s a five-month high.

Much of this was fueled by ongoing and solid increases in the cost of shelter, energy, and services. Shelter, for instance, rose by 4.6 percent, year over year.

This contradicts months of claims from Jerome Powell and other Federal Reserve mouthpieces who have insisted that price inflation was rapidly returning to the Fed’s two-percent price inflation goal. This was key for the Fed’s attempts to justify the FOMC’s jumbo 50-basis-point cut to the federal funds rate in September.

Yet, since the September cut, price inflation has either flattened or increased, with no indication that “two-percent” is rapidly approaching.

While the CPI is hitting multi-month highs, we also find that the less volatile core CPI was still higher in December than it was in August, before the FOMC’s cut to the target rate. Year over year, core CPI rose by 3.2 percent in December. This is the lowest year-over-year increase in four months, but it remains above the same measures from July and August. Core CPI remains well above every core CPI reading from the mid 1990s through 2020. Core CPI can only be described as “elevated” and there is no evidence here that Powell and friends are right about its claimed downward slide.

Of course, the Fed bases its two-percent goal not on regular CPI, but on the PCE measure of price inflation. The PCE numbers are not yet released for December, but in the most recent PCE number (for November) we find that PCE price inflation is actually increasing.

Since September 2024, year-over-year PCE price inflation has risen from 2.1 percent to 2.4 percent. Month-to-month, PCE has risen every month for the past six months.

Nowhere in any of these numbers do we find any danger of the CPI actually going down. Powell and the Fed “experts” would have us believe that falling prices are a grave danger, but price deflation would simply mean that the cost of living goes down.

Nonetheless, in practice, the Fed largely concerns itself with making sure that consumer prices only go up in excess of two percent per annum. Although the Fed claims its target is two-percent “on average,” it is clear that two percent is actually a floor, rather than an average. Powell has publicly rejected the suggestion that the FOMC try to bring CPI inflation below two percent for a period after so long a period well above three percent.

So, we can hardly be surprised when we find that the CPI index is up by 21.3 percent over the past four years, and yet the Fed decides that cutting the target interest rate and returning to looser monetary policy is the way to go. The Fed may claim that its policies have also increased wages, but wages have not kept up, according to the federal government’s own numbers. Over the same four years, average hourly wages have increased by 19.4 percent.

Put another way, nominal average hourly earnings have increased from about $30 since the end of 2020 while the CPI-adjusted wage fell about 50 cents. This is what the Fed and Jerome Powell describe as a “strong” economy.

It’s also worth noting that these numbers are “best case scenario” in terms of data accuracy. CPI numbers are notoriously subject to manipulation in the service of minimizing the actual impact of price inflation. So, the fact that price inflation has grown nearly 10 percent faster than average hourly wages over the past four years is likely the best possible spin the federal government could put on the numbers.

In any case, it’s safe to say that the dollar has lost more than a fifth of its value over the past 48 months which means that anyone who is on a fixed income, or who can’t afford exotic investment instruments designed to chase yield, is losing more and more of his or her savings with each passing month.

So why has the Fed apparently put the stated goal of two-percent price inflation on the back burner? The realities of deficit spending mean the Fed can’t afford, politically speaking, to focus on price inflation right now. Given the runaway annual deficits and the federal debt, the Fed must turn its attention to doing what it has always done since its creation: intervene in debt markets to prevent interest rates on Federal debt from getting out of hand. It is clear the Fed already has its work cut out for it in this regard. Since September, yields on Treasurys have repeatedly increased, even as the Fed has tried to reduce interest rates. Meanwhile, the Federal government is barreling toward an annual deficit of at least three trillion dollars. History has shown that, in spite of the myth of Fed independence, the Fed is actually a very reliable partner of the Treasury Department when the Treasury “asks” the Fed to focus on pushing down interest rates in the interests of debt management. The Fed has repeatedly done this during wartime, and did it during the 1970s. The Fed’s sudden about face on interest rates since September reflects this political reality.