I have heard a lot of Republicans and conservatives warn about the fiscal crisis that will come from the increase in government debt, not just in the US, but all over the world. I didn’t seem to get it, partly due to the fact that we have not had an “official” crash since 2008 and government debt has ballooned globally. Last year, I decided to really study to know why.

One of the best materials I found online was a Bob Murphy speech titled, “Who Bears the Burden of Government Debt?” The main reason Dr. Murphy gave was that government debt is taking today what would need to be repaid in the future. In other words, government debt is the current generation spending what would need to be paid back by the future generation. I appreciated that, but I felt like something else was missing—or so I thought but never got to it.

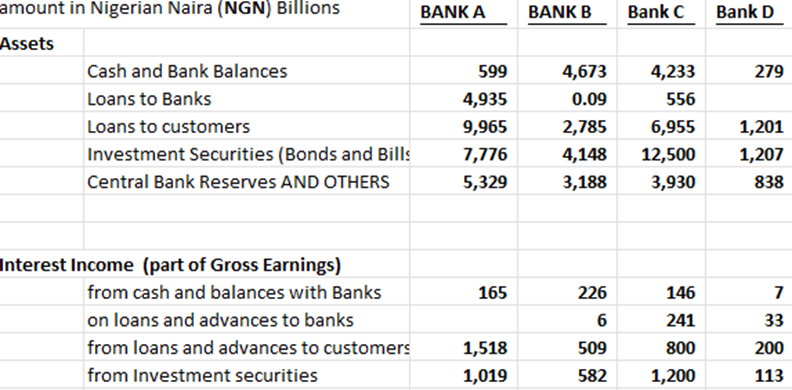

That was until recently as I came across the 2024 annual general reports of top Nigerian banks. Here are the actual snippets from bank statements of actual top Nigerian banks—their names withheld. The figures are shown below:

Bank A, B, C are among the largest banks in Nigeria and listed on the premium board of the Nigerian Stock Exchange. The other bank is also listed on the Nigerian stock exchange but is smaller. From the results above, one can see that a significant proportion of each bank’s assets are placed in investment securities, which is mostly—up to 90 percent in most of the banks in 6the figure above—treasury bills and bonds (i.e., government debt).

The impact of this asset strategy is seen in the interest income of the banks in the figure above with 32 percent to 50 percent of their interest income coming from interest in government debt alone. For the banks in the figure above, their investment in investment securities represent 27 percent to 44 percent of their total assets—and this excludes other assets like central bank reserves and loans to banks of which significant amounts are also used to purchase government debt. For comparison, US banks typically tend to keep around 10 percent of their assets in government debt. It is also good to remember that banks were created to loan most of their funds to individuals and private businesses (or so we thought).

Another important point to note for Banks A to D was that most of the private sector loans that were made by the banks went to large corporations with the oil and gas sector receiving the largest share of all the non-financial/money sectors of the Nigerian economy.

Coupling all this information with our knowledge of the Austrian business cycle and fractional reserve banking, we can clearly see what is going on—the central banks in conjunction with these big banks create new money, the banks get sizeable chunk of the new money through the interest from buying government debt (their interest income in the figure above) and capital gains, the government gets new money to spend as they see fit, and big corporations then get the money early in the cycle before the inflation hits the rest of the population.

The government and its allies continue to prosper, banks and big corporations all earn handsome profits—leaving Nigerians shocked at how banks continue to earn that much while businesses (small and medium) engaged in actual production of tangible goods continue to shut down and inflation continues to bite. The gainers are the government, banks, big corporations, and the suckers unfortunately are the rest of the people in the economy.

In conclusion, the complementing answer to the question posed by the great Bob Murphy—who bears the burden of government debt?—can thus be stated. It is not just the future generation who bears the burden of increased government debt, but the current generation who pay the interest to the banks and corporations through higher taxes and higher price inflation.