Volume 17, No. 1 (Spring 2012)

ABSTRACT: The financial crisis and the events leading up to it have sparked a remarkable renewal of interest in Austrian Business Cycle Theory (ABCT). A number of mainstream macroeconomists have criticized this resurgence of interest in ABCT on the grounds that the theory cannot explain the positive correlation of consumption and investment that occurs over the course of the business cycle. They allege that the theory predicts a slump in investment and capital goods’ industries and a corresponding boom in consumption during the recession. They therefore conclude that ABCT is manifestly in conflict with the stylized facts of the business cycle. In this paper I respond to these claims. I argue that the mainstream interpretation misrepresents essential features of the theory and conflicts with its presentation by its leading proponents. I then present an alternative formulation of the theory based on the works of Mises, Hayek and Rothbard. I argue that this version does satisfactorily account for the overconsumption boom and subsequent retail slump that were such conspicuous elements of the boom-bust cycle that played out over the past decade.

KEYWORDS: Austrian, business cycle, financial crisis, Mises, Hayek, Rothbard

JEL CLASSIFICATION: E32, B53

INTRODUCTION

The financial crisis and the events leading up to it have sparked a remarkable renewal of interest in Austrian Business Cycle Theory (ABCT). Several high profile investment advisers and financial commentators have employed the ABCT in their interpretation of the crisis. They have been inspired to revisit this theory as a result of the manifest failure of mainstream macroeconomists to foresee or explain the subprime mortgage crisis and its subsequent metamorphosis into a pandemic financial meltdown that led to the longest recession since World War II. Interest in the theory was reinforced by the fact that a number of economists and journalists associated with the modern Austrian school had warned of an emerging housing bubble during the Greenspan era when the conventional wisdom was that the Federal Reserve System had matters well in hand (Thornton, 2009).

Some prominent (and not so prominent) mainstream macroeconomists have not responded kindly to the sudden resurgence of interest in ABCT. But rather than openly subjecting the theory to rigorous, scholarly analysis in the standard research forums of academic journals and professional conferences, they have sniped at the theory on blog sites and in the popular press. Furthermore, in their haste to find flaws in the theory, they have disregarded the works of its originators and leading proponents, such as Ludwig von Mises, Friedrich A. Hayek, and Murray Rothbard. Instead they have drawn upon a single secondary source that portrays ABCT as a “monetary overinvestment theory” of the business cycle. The theory is thus described in the influential survey of business cycle theories published under the auspices of the League of Nations in 1937 by Gottfried Haberler (1963, pp. 33–72).3 The result is that their criticisms are aimed at a theory that grossly misrepresents ABCT in essential respects.

The gist of their critiques is that ABCT cannot explain the positive correlation of consumption and investment that occurs over the course of the business cycle. In particular they allege that the theory predicts a slump in investment and capital goods’ industries and a corresponding boom in consumer spending and retail sales during the recession. They therefore conclude that ABCT is manifestly in conflict with the stylized facts of the business cycle and should not be seriously entertained.

The central thesis of this paper is that ABCT, rightly understood, does satisfactorily account for the overconsumption boom and subsequent retail slump that were such conspicuous elements of the boom-bust cycle that played out over the past decade. In arguing my case, I clarify or reformulate ABCT on several points. First, I document and emphasize the neglected point that the Austrian theory is not an “overinvestment theory” of the business cycle and was never construed as such by its most notable proponents. Second, I explicitly extend the analysis of the effects of the central bank’s manipulation of interest rates from entrepreneurial choice among the length of production processes to household choice among intertemporal consumption patterns. Most accounts of ABCT focus almost solely on the “malinvestments,” that is, the intertemporal misallocations of resources, which are induced by the permanent gap between the loan rate and the natural rate of interest created by expansionary monetary policy. By formally integrating the “wealth effect” into ABCT, I am able to show how the illusory profits and inflated factor incomes and asset prices caused by money and bank credit expansion promote the falsification of households’ assessment of their net worth and the distortion of their consumption/saving choices. Thus the overconsumption that is typically observed during the boom is established as a coordinate effect with entrepreneurial malinvestments in the production structure attributable to the same cause: the distortion of the interest rate by monetary expansion. Whether one or the other effect predominates during a given boom depends on the historical data. My third refinement of ABCT is to link the so-called “secondary deflation” to the pervasive malaise and waning of “animal spirits” among the mass of entrepreneurs that occurs when the recession reveals their cluster of miscalculations and errors and saps their confidence in their ability to identify and calculate profitable investments. I argue that the secondary deflation is not the result of an incidental monetary contraction that depresses some arbitrary price level; rather it is a reaction to and correction of the relative price distortion caused by the extreme overbidding of factor and asset prices during the euphoria of the boom. When allowed to run its course, this relative price adjustment inevitably re-establishes a natural interest rate sufficiently high to stimulate capitalists and entrepreneurs to dishoard cash and actively seek out investment opportunities. When stunted by “quantitative easing” and fiscal deficits driven by stimulus programs, the entrepreneurial malaise becomes chronic, and economic stagnation ensues.

In section 2, I briefly delineate the dimensions of the recent retail slump, and show that, in several respects, it was indeed unprecedented. The criticisms of ABCT by mainstream macroeconomists alleging that the theory cannot account for such a development are surveyed in section 3. I respond to these criticisms in section 4 arguing that ABCT is not an “overinvestment theory” at all. Rather, I argue, both “malinvestment” and “overconsumption” occur contemporaneously during the boom and whether one or the other effect predominates is determined by concrete historical circumstances. I also indicate how my argument differs from that presented by Roger Garrison (2001, 2004), which reaches the same conclusion by a different route.4 Section 5 discusses the overconsumption and “capital consumption” that occurred during the boom leading up to the financial crisis and gives a summary assessment of their magnitude and relation to the ensuing retail slump. I outline the implications of my reformulation for the analysis of the phenomenon of “secondary deflation” in section 6. I conclude in section 7.

2. THE RETAIL SLUMP IN THE GREAT RECESSION OF 2007–2009.

Perhaps the most prominent feature of the recent recession in the U.S., aside from the collapse of the housing sector, was the exceptionally severe retail slump that characterized it. One indication of its severity was the precipitous decline in retail and food service sales. For December 2008, the year-over-year decline in current dollar sales was 11.1 percent and from January though July 2009 these year-over-year declines fluctuated between 8.5 percent and 10.5 percent (Federal Reserve Bank of St. Louis [2010b]).5 Except for two nonconsecutive months during the recession of 1990–1991 in which the percent change in monthly retail sales dipped slightly below zero on a year-over-year basis, one would have to go back to 1960–1961 to find declines in current dollar retail sales during a recession, although nothing like the magnitude experienced during the latest recession.6

Real retail sales (Figure 1) also took an exceptionally sharp plunge during the recession. For example, in all previous recessions beginning with the 1960–1961 recession, monthly real retail sales compared to a year ago decreased by 8 percent or more for only three months, all in the mini-recession of 1980. By contrast, during the 2007–2009 downturn real retail sales on a year-over-year basis contracted by 8 percent or more for nine consecutive months, ending in May 2009 (Federal Reserve Bank of St. Louis [2010b]). Overall, year-over year retail sales growth was negative for 23 consecutive months ending November 1, 2009. As of April, 2010, real retail and food service sales, seasonally adjusted, stood at $166.886 billion, above its recessionary trough of 158.109 for February 2009, but still well below its local pre-recession peak of $180.290 billion of October 2007.

Figure 1.

The qualitative dimensions of the retail slump can be traced in the broad range of iconic American retailers that succumbed to bankruptcies, liquidations, or massive retrenchments. Chrysler filed Chapter 11 on April 11, 2009 followed by GM on June 1, 2009. KB Toys, one of the largest U.S. toy retailers, sought Chapter 11 protection in December 2008 and announced that it planned to close all of its 460 retail outlets. Circuit City, the second largest electronics retailer in the U.S., declared bankruptcy and closed all of its 575 stores in 2009. Midsize electronics retailer CompUSA closed all of its 103 outlets (although it has since sold its name and 16 of its sites and returned under a new owner). Sharper Image, a leading novelty and electronics retailer, also declared bankruptcy. Linen ‘N Things, the second-largest home goods retailer in the U.S. filed Chapter 11 and liquidated its 371 stores. Fortunoff, a leading jewelry and home furnishing chain in the Northeast, filed for bankruptcy, as did midsize furniture retailers Levitz and Bombay, both of which were liquidated. Many more retail chains scrapped expansion plans and proceeded with massive cuts in the number of their outlets, including Disney (98), Ann Taylor (117), Footlocker (140) and numerous others.7

3. THE MAINSTREAM CRITIQUE OF ABCT: A CASE OF MISTAKEN IDENTITY

As noted, recently some mainstream economists have criticized a potted version of ABCT that focuses almost exclusively on “forced saving” and corresponding “overinvestment” as the primary, if not the only, distortions occurring during the inflationary boom. The most influential formulation of this version was presented by Haberler (1963) in his survey of business cycle theories published in 1937 under the auspices of the League of Nations. According to Haberler’s interpretation, the boom phase of the cycle is initiated by bank credit expansion in the form of “fiduciary media” or unbacked demand deposits. This results in an increase in the supply of loanable funds beyond the level of voluntary saving. The artificially swollen supply of credit depresses the risk-adjusted interest rate on credit markets below the level of the “natural rate,” which is the rate of return on investment in the structure of production that is consistent with intertemporal consumption preferences. The artificially-depressed loan rate in turn induces additional business borrowing which causes spending on capital or “higher order” goods to increase relative to spending on consumer goods and other “lower order” goods such as direct inputs in the making of consumer goods.

Under conditions of full employment, the diversion of more of the aggregate spending stream from consumer goods’ to capital goods’ industries causes a corresponding change in relative prices that reallocates resources from the former to the latter industries. The expansion of the production of capital goods thus comes at the expense of the production of consumer goods, thereby causing the prices of consumer goods to increase and consumption to be restricted. This phenomenon is known as “forced saving,” because the redirection of resources from consumer goods’ production to capital goods’ production caused by bank credit expansion does not comport with the voluntary saving preferences of households.

The expansionary phase of the cycle comes to an end when the central bank reacts to accelerating consumer price inflation or some other event by significantly restricting its expansion of bank reserves. Credit markets tighten and the risk-adjusted interest rate rises toward its natural level, once again constricting investment to the limits imposed by voluntary saving. The higher interest rates bring the investment boom to a halt. Firms producing capital goods, especially specialized machines, tools and other equipment relatively specific to processes temporally remote from consumers, encounter an unanticipated drop in spending on their output and, consequently, declining prices and profits. At the same time the spending stream directed toward consumer goods continues to swell for a while because previous injections of new money already paid out in wages and rents by capital goods’ producers are transformed into spending on consumer goods only after a lapse of time. As a result, the price of labor continues to be bid up by consumer goods’ firms.

Faced with increasing wage rates and the rising cost of credit, capital goods’ producers can no longer profitably sustain production at current levels. Payrolls and other variable costs are slashed and plant and equipment are idled, as some firms retrench and others shut down altogether. Unemployment rises and the recession sets in.

During the recession, spending on capital goods declines relative to spending on consumer goods. This represents a reversal of the change in relative spending streams that characterized the boom and initiates an adjustment process that re-establishes an optimal pattern of employment for labor and other resources that once again accords with the intertemporal consumption preferences and voluntary saving of market participants. The “structure of production” is thus re-oriented to deliver more consumer goods in the present and near future and fewer in more distant future periods.

It is important to note a salient feature of the foregoing account of ABCT. There are no references to the entrepreneur, monetary calculation, uncertainty or expectations. In Haberler’s formulation, the cycle is driven exclusively by the relative swelling and contracting of current spending streams directed toward different sectors of the economy. The interest rate on loans is merely a mechanism operating directly to enlarge or constrict the channels of these spending flows. Regardless of what causes the change in the interest rate, the effect on the relative spending flows is always symmetrical. Specifically, a fall in the loan rate will enlarge relative spending on capital goods and move resources to higher stage uses from lower stage uses. A rise in the interest rate will have reverse effects on relative spending flows and resource movements.

There are three implications of what we may call this “hydraulic” conception of ABCT. First, the boom involves a shift of labor and other resources out of consumer goods’ into capital goods’ industries, while the recession involves a symmetrical resource shift in the opposite direction. Second, the forced saving and overinvestment of the boom is accompanied by a decline in consumption and shrinkage of the finished consumer goods’ manufacturing, wholesale, and retail sectors as resources are reallocated to the higher stages of production. Third, the recession is characterized by an expansion of consumption as the overinvestment of the boom is revealed and corrected and the temporarily misplaced resources are released back into processes producing goods for consumption in the near future. The new production structure pretty much resembles the old, pre-overinvestment structure, except for some “fixed” capital that may have been sunk in higher stage production processes that had to be abandoned before completion.

Haberler (1963, p. 71) recognized these implications, commenting:

It is a little difficult to understand... why the transition to a more roundabout process of production should be associated with prosperity and the return to a less roundabout process a synonym for depression. Why should not the original inflationary expansion of investment cause as much dislocation in the production of consumers’ goods as the subsequent rise in consumers’ demand is said to cause in the production of investment goods?

Mainstream critics have seized on Haberler’s hydraulic conception of ABCT to dismiss the theory as manifestly inconsistent with the stylized facts of the business cycle. In particular it is observed that, over the business cycle, investment and consumption are positively correlated and the movement of factors back to consumer goods’ industries during the recession is accompanied by substantial unemployment of labor that was absent during the movement of factors to capital goods industries during the boom. Indeed the recent mainstream criticisms of ABCT have been little more than a parroting of Haberler’s original critique in 1937.

Without attribution to Haberler, Paul Krugman repeated this line of criticism in 1998. Dubbing ABCT “the hangover theory,” Krugman (1998) argued:

In the beginning, an investment boom gets out of hand. Maybe excessive money creation or reckless bank lending drives it; maybe it is simply a matter of irrational exuberance on the part of entrepreneurs. Whatever the reason, all that investment leads to the creation of too much capacity.... Here’s the problem: As a matter of simple arithmetic, total spending in the economy is necessarily equal to total income (every sale is also a purchase, and vice versa). So if people decide to spend less on investment goods, doesn’t that mean that they must be deciding to spend more on consumption goods—implying that an investment slump should always be accompanied by a corresponding consumption boom? And if so why should there be a rise in unemployment?

Following Krugman’s article, a parade of lesser Keynesian macroeconomists and economist-bloggers weighed in with more or less the same argument. For example, George Mason University economist Tyler Cowen (2008) applauded Krugman’s criticism and added a minor gloss of his own, commenting:

But I think the point is more effective in reverse. Why should the boom be a boom in the first place? The shift toward investment goods, and thus away from consumption goods production, should mean falling real wages, not rising real wages. In other words, the Austrian theory doesn’t generate the very high degree of comovement found in the data. Or, in other words, there aren’t that many countercyclical assets.

As I will argue below, Cowen’s statement perfectly reflects the lack of comprehension of the most potent factor distorting monetary calculation and leading to overconsumption during the boom.

Berkeley macroeconomist and former U.S. Treasury official Brad DeLong (2008) characterized ABCT as a Haberlerian overinvestment theory:

Something—irrational exuberance or fractional reserve banking or loose monetary policy—had pushed the market’s tolerance for risk above “sustainable” levels, the economy had responded by “overinvesting” in capital, and no cure was possible that did not involve a recognition that capital had been overinvested and wasted and that the economy’s capital stock needed to shrink.8

Predictably, Delong’s critique of the theory was remarkably similar to Krugmans’s (and Haberler’s). Argued DeLong (2010):

There is generally no period of high unemployment when resources are transferred out of consumption-producing sectors into investment goods-producing sectors. There is no necessity that the transfer of resources out of investment goods-producing sectors be accompanied by high unemployment. The business of shifting resources between sectors is pretty much orthogonal to the business of maintaining near full-employment and proper capacity utilization.

Australian economist John Quiggin presented a similar objection to ABCT, concluding:

...[U]nless Say’s Law is violated, the Austrian model implies that consumption should be negatively correlated with investment over the business cycle, whereas in fact the opposite is true. To the extent that booms are driven by mistaken beliefs that investments have become more profitable, they are typically characterized by high, not low, consumption.

Lastly, we quote George Mason University economist Bryan Caplan (2008) who gave perhaps the most trenchant critique of hydraulic ABCT:

The Austrian theory also suffers from serious internal inconsistencies. If, as in the Austrian theory, initial consumption/investment preferences “re-assert themselves,” why don’t the consumption goods industries enjoy a huge boom during depressions? After all, if the prices of the capital goods factors are too high, are not the prices of the consumption goods factors too low? Wage workers in capital goods industries are unhappy when old time preferences re-assert themselves. But wage workers in consumer goods industries should be overjoyed. The Austrian theory predicts a decline in employment in some sectors, but an increase in others; thus, it does nothing to explain why unemployment is high during the “bust” and low during the “boom”.... [T]he theory does not predict an increase in employment during the boom, or a decrease during the bust. Moreover, it predicts an actual increase in current output during the bust. These are puzzling implications, to put it mildly, and they follow from the ABC[T].

All of the foregoing critiques are essentially the same in a crucial respect: they are based on a view of ABCT as simply a garden-variety neoclassical theory of sectoral shifts. This is encapsulated in the term “overinvestment” which implies too many resources allocated to the capital goods’ sector and too few to the consumer goods’ sector. Overinvestment always logically implies underconsumption in this two-sector model, whose relative price is the interest rate. This model differs not in the least from a two-commodity, two-country international trade model with increasing costs and incomplete specialization. In this model the imposition of a tariff, say, on wine will distort the relative price between wine and cloth, increasing the relative price of wine and stimulating the movement of resources from cloth to wine in the country importing wine. The relative price and flow of resources will move in the opposite direction in the wine-exporting country. If the tariff is then removed, the result will be a counter-movement of resources out of each country’s import-competing industry into its export sector.

Now let us go a little beyond the comparative static model of undergraduate textbooks and assume: an imperfect degree of labor mobility; a production function for each good that includes inconvertible fixed capital; and static expectations about policy. In this case, there will be a “boom” in the import-competing sector and a “bust” in the export sector of both countries when the tariff is initially imposed. Transitory unemployment will appear and some investment in fixed capital will be lost, but things will go on pretty much as they had before. These effects will be exactly symmetrical in the opposite direction when the tariff is removed.

Note that variations in the money supply are not completely neutral in this trade model despite the fact that there is only one relative price. If we assume that individual value scales are differentiated from one another and that unanticipated injections of new money initially are unevenly distributed to those consumers whose marginal valuations favor wine over cloth, then the price of wine will rise relative to cloth and the same pattern of boom and bust will occur in the two industries that occurred in the tariff case. The effects of unexpectedly halting the monetary injections will correspond to effects of the tariff removal. Thus the Haberlerian-mainstream caricature of ABCT describes a nonmonetary theory of a self-reversing shift of resources between two sectors. The only role played by money is to cause the initial distortion of the single relative price in a two-sector economy. Thus in the hydraulic model, monetary expansion causes precisely the same diversion of spending flows and relative prices as a tariff or many other nonmonetary interventions into the economy. But ABCT was designed to explain the unique distortions created in the real economy and its production structure by an inflationary boom. Indeed, the very essence of ABCT, the falsification of monetary calculation, plays no role whatever in the hydraulic model.

4. ABCT: A THEORY OF OVERCONSUMPTION AND MALINVESTMENT

Had the critics seriously studied the original sources in which ABCT is expounded, they would have learned that it is not an “overinvestment” theory at all. In fact, Mises, Rothbard and, somewhat less emphatically, Hayek argued explicitly that “overconsumption” and “malinvestment” were the essential features of the inflationary boom. In their view, the divergence between the loan and natural rates of interest caused by bank credit expansion systematically falsifies the monetary calculations of entrepreneurs choosing among investment projects of different durations and in different stages varying in temporal remoteness from consumers. But it also distorts the income and wealth calculations and therefore the consumption/saving choices of the recipients of wages, rents, profits and capital gains. In other words, while the artificially reduced loan rate encourages business firms to overestimate the present and future availability of investible resources and to malinvest in lengthening the structure of production, at the same time it misleads households into a falsely optimistic appraisal of their real income and net worth that stimulates consumption and depresses saving.

Although overconsumption is caused directly by what may be called the “wealth” or “net worth” effect, it is financed by the increase in the money supply and, later in the boom, the drawing down of cash balances as inflationary expectations take hold. On the real side, the increase in the prices and profitability of consumer goods diverts factors from higher stages to consumer goods’ industries, thereby restricting the supply of resources available to add to or even replace the stock of capital goods. This is what Austrian economists call “capital consumption,” which is a pervasive feature of the boom. Far from being the essence of ABCT, overinvestment is thus logically ruled out by it—the boom results in the production of fewer not more capital goods.

Mises (1998, pp. 546–547) vividly described the nature and implications of overconsumption:

It would be a serious blunder to neglect the fact that inflation also generates forces which tend toward capital consumption. One of its consequences is that it falsifies economic calculation and accounting. It produces the phenomenon of imaginary or apparent profits.... If the rise in the prices of stocks and real estate is considered as a gain, the illusion is no less manifest. What make people believe that inflation results in general prosperity are precisely such illusory gains. They feel lucky and become open-handed in spending and enjoying life. They embellish their homes, they build new mansions and patronize the entertainment business. In spending apparent gains, the fanciful result of false reckoning, they are consuming capital. It does not matter who these spenders are. They may be businessmen or stock jobbers. They may be wage earners....

Rothbard (2000, p. 30) also emphatically rejected the overinvestment explanation of ABCT on essentially the same grounds as Mises, referring to it as a “misconception... given currency by Haberler’s famous Prosperity and Depression.” According to Rothbard (2004, p. 993):

Superficially, it seems that credit expansion greatly increases capital, for the new money enters the market as equivalent to new savings for lending. Since the new “bank money” is apparently added to the supply of savings on the credit market, businesses can now borrow at a lower rate of interest; hence inflationary credit expansion seems to offer the ideal escape from time preference, as well as an inexhaustible fount of added capital. Actually, this effect is illusory. On the contrary, inflation reduces saving and investment.... It may even cause large-scale capital consumption.

After discussing the falsification of capital accounting and resulting overstatement of profits caused by inflation, Rothbard (2004, pp. 993–994) concluded

Inflation, therefore, tricks the businessman: it destroys one of his main signposts and leads him to believe that he has gained extra profits when he is just able to replace capital. Hence, he will undoubtedly be tempted to consume out of these profits and thereby unwittingly consume capital as well. Thus, inflation tends at once to repress saving-investment and to cause consumption of capital.

This brings us to the role of forced saving as the source and impetus to overinvestment. As already noted, according to the hydraulic version of ABCT, forced saving occurs during the boom when income is redistributed from those whose marginal valuations of present over future consumption or “time preferences” are higher to those whose time preferences are lower. This will result in an overall increase in saving relative to consumption and therefore in the supply of investible resources in the economy. This forced saving will fuel the overinvestment. Mises rejected this argument for two reasons. First he noted that forced saving is not a necessary outcome of inflation; it is contingent upon the concrete data that shapes a historical inflationary process. Argued Mises,

[O]ne must realize that forced saving can result from inflation, but need not necessarily. It depends on the particular data of each instance of inflation whether or not the rise in wage rates lags behind the rise in commodity prices. A tendency for real wage rates to drop is not an inescapable consequence of a decline in the monetary unit’s purchasing power. It could happen that nominal wage rates rise more or sooner than commodity prices....

Second, and more important, is the point that even when circumstances prevailing at the beginning of an inflation foster forced saving to such an extent that resources are released from consumer goods’ and other lower stage industries, the situation will inevitably be reversed as the boom progresses. Inflationary expectations eventually intensify and become widespread, amplifying the tendency toward overconsumption to the point where it overwhelms the tendency to forced saving. Mises (1998, pp. 555–556) thus concluded:

[W]ith the further progress of the expansionist movement the rise in the prices of the consumers’ goods will outstrip the rise in the prices of the producers’ goods. The rises in wages and salaries and the additional gains of the capitalists, entrepreneurs, and farmers, although a great part of them is merely apparent, intensify the demand for consumers’ goods.... It is customary to describe the boom as overinvestment. However additional investment is only possible to the extent that there is an additional supply of capital goods available. As, apart from forced saving, the boom itself does not result in a restriction but rather in an increase in consumption, it does not procure more capital goods for new investment. The essence of the credit-expansion boom is not overinvestment, but investment in wrong lines, i.e., malinvestment.

Hayek’s conception of forced saving was different from Mises’s, as Roger Garrison (2004) has noted. Mises used the term “forced saving” to denote an actual increase in saving that results when credit expansion redistributes income from workers, typically possessing relatively high time preferences, to capitalist-entrepreneurs, whose time preferences are typically lower. Hayek, in contrast, conceived of forced saving as a pattern of investment that is inconsistent with prevailing time preferences, a situation which, as we shall see below, Mises referred to as “malinvestment.” Nevertheless, despite this terminological difference, Hayek too recognized that both forced saving (malinvestment) and overconsumption characterized the boom.

Hayek argued that a constant rate of forced saving would require an increasing rate of credit expansion in order to allow capitalists to maintain and expand the labor force and complementary factors devoted to producing an elongated capital structure by successfully countering rising bids for these factors by the producers of consumer goods. The continual pressure to expand consumer goods’ production exerts itself through the ever-rising wages paid out in the higher stage industries. These higher wages, which result from the previous injection of new money through credit expansion, appear as increased demand by laborers on consumer goods’ markets after a lapse of time. Prices of consumer goods are thus driven up, approximating the rate of inflation for capital goods after a short lag and causing the wages offered by consumer goods’ producers to rise apace. Now in order to maintain the rate of forced saving constant, i.e., sustain the existing gap between investment and voluntary saving over time, it would be necessary to continually divert additional labor and land factors during successive time periods to the higher stages. As Hayek (2008, p. 319) argued, this requires that credit expansion be renewed at a continually increasing rate. Eventually the increasing rate of price inflation would ignite inflationary expectations, distort monetary calculation and falsify capital accounting, culminating in overconsumption and capital destruction.

Hayek (2008, pp. 320–321) described the forces leading to overconsumption in an appendix to the second edition of Prices and Production published in 1935:

[W]hether the prices of the consumer’ goods will rise faster or slower, all other prices, and particularly the prices of the original factors of production, will rise even faster. It is only a question of time when this general and progressive rise of prices becomes very rapid. My argument is not that such a development is inevitable once a policy of credit expansion is embarked upon, but that it has to be carried to that point if a certain result—a constant rate of forced saving, or maintenance without the help of voluntary saving of capital accumulated by forced saving—is to be achieved.

Once this stage is reached, such a policy will soon begin to defeat its own ends. While the mechanism of forced saving continues to operate, the general rise in prices will make it increasingly difficult, and finally practically impossible, for entrepreneurs to maintain their capital intact. Paper profits will be computed and consumed; the failure to reproduce the existing capital will become quantitatively more and more important, and will finally exceed the additions made by forced saving.9

So like Mises and Rothbard, Hayek also believed that overconsumption was a defining characteristic of the boom, although he admittedly did not attribute to it such a prominent role as Mises did.10 Thus, I cannot completely agree with Roger Garrison (2004, p. 333) when he concludes, “Almost, inexplicably Hayek never gives play to the overconsumption that accompanies credit expansion or even acknowledges the possibility of it.” Garrison (2004, pp. 327–328) also does not quite capture the essence of the overconsumption effect as formulated by Mises when he portrays it mainly as an outcome associated with a policy-induced fall in the interest rate conceived as an incentive to consume more and save less. Mises attributed overconsumption to the distortion of monetary calculation caused by credit expansion, which induces entrepreneurs and households to overestimate their income and net worth. For Mises, the interest rate is much more important in its role as a discount factor than as an inducement to save.11 As the inflationary boom proceeds, profits begin to regularly exceed even the most optimistic expectations. These “paper profits,” as Hayek calls them, become almost universal, creating a general climate of over-optimism and “irrational exuberance” that undermines shrewd entrepreneurial judgment. Reinforced by inflationary expectations, this results in a growing overestimation of prospective profit streams which, when discounted by the artificially low interest rate, generates fictitious capital gains throughout the structure of production that are completely unhinged from the fundamental realities.

At this point capital accounting becomes a storybook of fantasies and self-delusion rather than a reckoning based on a sober judgment of the future. In addition to the emergence of phantom profits and capital gains, a rapid rise in wages is caused by the attempt of entrepreneurs throughout the production structure to acquire the factors necessary to expand their operations in the later phases of the boom. This wage spiral and the expectations it engenders also fosters overconsumption. The overall result of these inflation-induced distortions of income and wealth is, as Rothbard (2009, p. 793) pointed out, that “the market’s consumption/investment ratio” or time preference is systematically increased, thus driving up the natural rate during the boom. The gap between the natural rate and the policy-distorted interest rate thus widens, causing entrepreneurial miscalculations and malinvestments to proliferate and intensify.

To those critics who object that ABCT implicitly assumes “money illusion” on the part of entrepreneurs, the answer is that in a dynamic economy with a complex capital structure the only method available to entrepreneurs for reliably estimating the outcome of their decisions and investments is monetary calculation. Hayek (2008, p. 321) made this assumption explicit in Prices and Production, writing:

It is important... to remember that the entrepreneur necessarily and inevitably thinks of capital in terms of money, and that, under changing conditions, he has no other way of thinking of its quantity then in value terms, which practically means in terms of money. But even if, for a time, he resists the temptation of paper profits (and experience teaches us that this is extremely unlikely) and computes his costs in terms of some index number, the rate of depreciation has only to become fast enough, and such an expedient will be ineffective.

Now the same calculational distortion that produces overconsumption also concurrently produces the phenomenon of malinvestment. Since the supply of capital goods are diminished by overconsumption, overinvestment cannot conceivably occur. However, to the extent that the newly created bank credit is first obtained by entrepreneurs at reduced interest rates, they have the means and the incentive to expand their operations or to initiate wholly new investment projects whose funding exceeds the available quantity of voluntary savings. The demands and prices for higher stage goods necessary to carry out these investments are increased and there is a corresponding rise in the capital values of firms producing these goods. Resources are diverted into producing new mining and oil drilling equipment, site planning and preparation for new hydroelectric plants, developing computer software for use in designing solar-powered aircraft and so on.12 At the same time, factors are being overused in supplying direct inputs to the manufacturers of finished consumer goods and in more intensively operating their facilities, as well as in constructing and manning additional warehouse and retail space. These malinvestments at both ends create a “hole” in the middle stages of the structure of production, which is “papered” over by profits and capital gains caused by the falsification of monetary calculation.

As the boom continues, firms confront an increasing scarcity of the resources necessary to fully utilize the new mining and oil drilling equipment, to construct the hydroelectric plant and to engineer and mass produce the new generation of aircraft. In a strictly metaphorical sense, then, we may say that the lengthened structure of production cannot be “completed.” The anticipated demands for the products of the higher stage investment projects, even if they are technologically operational, do not materialize because of the greater scarcity and costliness of the complementary labor and capital needed to profitably transform these products into lower order capital goods. At the same time and as part of the same process, other firms lower down in the structure of production that produce raw inputs, spare parts, and equipment for the supply, maintenance and repair of plants and equipment manufacturing finished consumer goods are also incurring rising labor costs, causing them to cut back on capacity.

From the economic point of view, malinvestment and capital consumption cause the structure of production to disintegrate into pieces that cannot be fitted back together again without a protracted recession-adjustment process. During this process both investment and consumption will decline causing unemployment to rise in both sectors. The recession will be further prolonged by the fact that entrepreneurs, after experiencing massive losses and capital write-downs, will temporarily lose confidence both in their ability to forecast future market conditions and in the reliability of monetary calculation. It is this loss of entrepreneurial confidence that is the crux of the so-called “secondary deflation.” Entrepreneurs will increase their demand for money and highly liquid assets and pass up potentially profitable opportunities that they would have seized upon in their normal state of confidence. Thus it is the endogenous factor of entrepreneurial pessimism and skittishness and not the exogenous factor of a contraction of the money supply that brings about the drop in the general scale of prices and, more important, in the prices of the factors of production relative to product prices. It is precisely the rise of the natural interest rate implicit in the relative decline of factor prices that restores the entrepreneurs’ natural optimism and venturesomeness.

In fact, as Mises (1998, pp. 568–569) explained, so-called “secondary deflation” is categorically distinct from a monetary deflation, for it is not the cause of a protracted recession-adjustment period but its essential consequence and cure:

Ignorance manifests itself... in the confusion of deflation and contraction and of the process of readjustment into which every expansionist boom must lead. It depends on the institutional structure of the credit system which created the boom whether or not the crisis brings about a restriction in the amount of fiduciary media…. [E]ven with no restrictions in the supply of money proper and fiduciary media available, the depression brings about a cash-induced tendency toward an increase in the purchasing power of the monetary unit. Every firm is intent upon increasing its cash holdings, and these endeavors affect the ratio between the supply of money... and the demand for money... for cash holding. This may be properly called deflation. But it is a serious blunder to believe that the fall in commodity prices is caused by this striving after greater cash holding. The causation is the other way around. Prices of the factors of production—both material and human—have reached an excessive height in the boom period. They must come down before business can become profitable again. The entrepreneurs enlarge their cash holding because they abstain from buying goods and hiring workers as long as the structure of prices and wages is not adjusted to the real state of the market data. [Emphasis added.]

The effects of the capital irretrievably sunk in unprofitable projects or mistakenly consumed as a part of current income remain even after the recession has liquidated the malinvestments, re-established monetary calculation on a sound footing, and renewed entrepreneurial risk-taking. The reconstructed capital structure will necessarily be shorter and, consequently, labor productivity, real wages and living standards lower. In sum, “The boom squanders through malinvestment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment” (Mises, 1998, p. 573).

5. OVERCONSUMPTION AND THE RETAIL SLUMP, 2002–2009

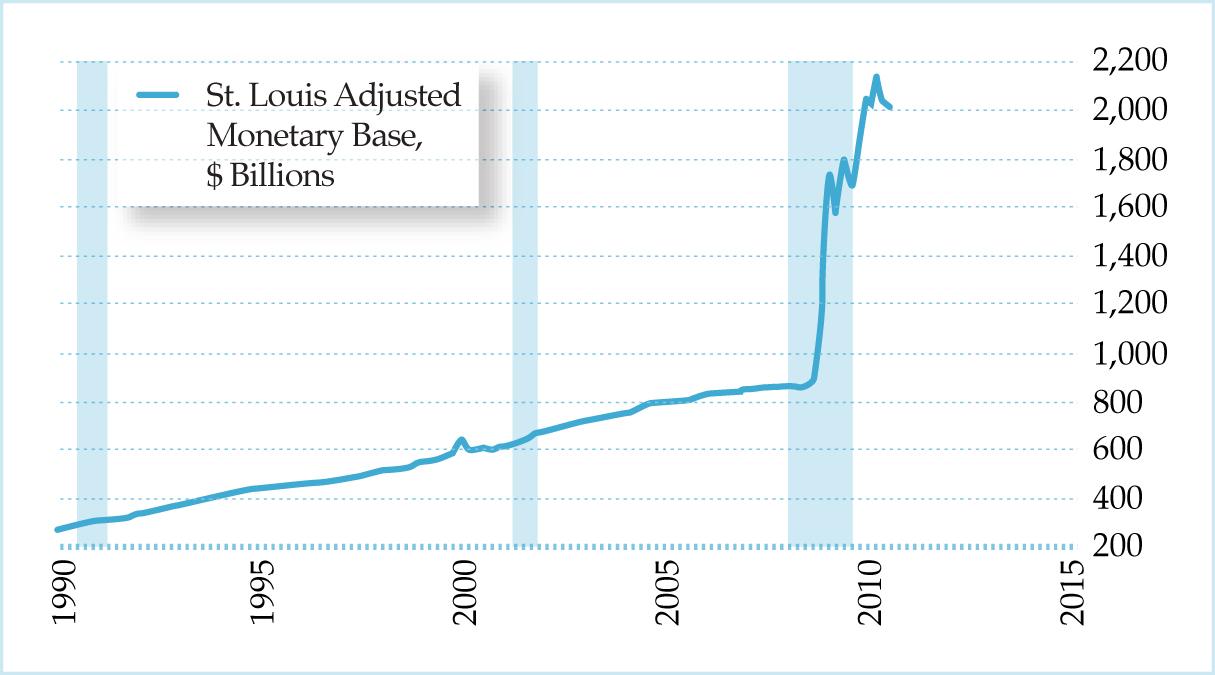

After nearly five years of increasingly rapid growth in the monetary base and the money supply, the Fed throttled back in 1999, triggering the bursting of the dot-com bubble in early 2000 and a recession in early 2001. The Fed reacted almost immediately to these events by aggressively lowering the target Federal Funds rate and reversing the decline in monetary growth. The events of 9/11 led the Fed to ratchet up its expansionary monetary policy. From the beginning of 2001 to the end of 2005, the Fed’s MZM monetary aggregate increased by about $1 billon per week and the M2 aggregate by about $750 million per week. During the same period the monetary base, which is completely controlled by the Fed, increased by about $200 billion, a cumulative increase of 33.3 percent (Figures 2, 3, 4).

Figure 2.

Figure 3.

Figure 4.

The Federal Funds rate was driven down below 2 percent and held there for almost three years, pegged at 1 percent for a year (Figure 5). The result was that the real interest rate, as measured by the difference between the Federal Funds rate and headline CPI, was negative from roughly 2003 to 2005. Rates on 30-year conventional mortgages fell sharply from over 7 percent in 2002 to a low of 5.25 percent in 2003 and, aside from brief upticks in 2003 and again in 2004, fluctuated between 5.5 percent and 6.0 percent until late 2005 (Figure 6). Perhaps, more significantly, 1-year ARM rates plummeted from a high of 7.17 percent in 2000 to a low of 3.74 percent in 2003, rising to 4.1 percent in 2004 and to slightly over 5 percent in 2005. In addition, credit standards were loosened and unconventional mortgages, including interest-only, negative equity, and no-down-payment mortgages, proliferated.13 This caused a rapid expansion of mortgage lending and of subprime mortgage lending in particular, with the subprime share of home mortgages outstanding rising steadily from 8.62 percent in 2000 to 13.51 percent in 2005 (Table 1). As a result of these developments, housing prices once again accelerated to double-digit annual increases after a short and shallow disinflation during the 2001 recession. The housing boom soon turned into a bubble as expectations lost contact with fundamentals and propelled housing prices upward at accelerating rates.

Figure 5.

Figure 6.

Table 1.

Figure 7.

By mid-2003, the credit expansion began to boost corporate profits (Figure 8), and stock prices, stagnant or declining since the bursting of the high tech bubble in 2000, began a steep ascent. While housing prices peaked in 2006, stock prices continued their rise into 2007 (Figures 9, 10).

Figure 8.

Figure 9.

Figure 10.

The sharply rising stock and real estate prices boosted household net worth by over $23 trillion during the three years 2003–2006 (Board of Governors of the Federal Reserve System [2010], p. 107). This drove the ratio of household net worth to annual GDP to well over 450 percent. By comparison, for over forty years, from 1952 until the dot-com boom began in mid-1990s, the household net worth to annual GDP ratio had held between 300 percent and 350 percent. After nearly falling back to this range after the recession of 2001, the Fed’s monetary expansion drove it up by 100 percentage points in a matter of three years (Figure 11).

Figure 11.

This enormous increase in net worth was based almost solely on paper profits and phantom capital gains on households’ real estate and financial assets. Misled by their inflation-bloated balance sheets, households were induced to “cash out” some of their home equity and increase expenditures on consumer goods and services. In the expression of the day, people began “using their homes as ATM machines.” Households financed their increased spending on boats, luxury autos, upscale restaurant meals, pricey vacations etc., through fixed-dollar debt. The increase in value of home equity and 401(k) plans also reduced saving out of current income, and the personal saving rate plunged from over 4 percent immediately after the recession of 2001 to less than 1 percent during 2005 (Figure 12).

Figure 12.

Thus while household assets rose by $21,743.3 trillion from 2003 to 2007, liabilities, mainly home mortgages and consumer credit, increased by $4,500.8 trillion during the same period (Board of Governors of the Federal Reserve System [2010], p. 104). One result of this was that the year-over-year rate of growth of household debt nearly doubled from 6 percent during 1997 to 11 percent for three consecutive years beginning in mid-2003. In addition, debt service payments as a percent of disposable personal income rose from 11 to 12 percent during the late 1990s to peak at 15 percent in 2007. (See Figures 13, 14)

Figure 13.

Figure 14.

When the boom came to an end in 2007, housing prices, corporate profits and the stock market plunged. The capital gains accumulated since the mid-1990s were revealed to be an illusion as household net worth declined by $13 trillion, or 20 percent, during 2008, a figure exceeding the sum of the combined annual GDP of Germany, Japan and the U.K. (Board of Governors of the Federal Reserve System [2010], p. 107). The ratio of household net worth to GDP fell from over 450 percent to less than 350 percent, reaching its 1994 level in early 2009. This brought the overconsumption frenzy, which had spanned two inflationary booms, to a screeching halt. Real retail sales and food services, which had plateaued at an annual rate of $180 billion during 2006 and 2007, declined precipitously to $160 billion in less than a year and remained stagnant for a year. Concurrently, firms in the retail sector shed over 1 million workers from their payrolls with employment dropping from a high of 15.56 million in December 2007 to a low of 14.36 million in December of 2009. On a year-over-year basis, retail employment shrank by 5 percent for more than half of 2009. The S&P Retail Stock Index (RLX) lost over half of its value between February 2007 and November 2009, falling from 533 to 223. Indeed, the fall in the RLX was as sharp and deep as the fall of the S&P 500. (See Figures 1, 15, 16, 17, 18, 19)

Figure 15.

Figure 16.

Figure 17.

Figure 18.

Figure 19.

The extent of capital consumption and malinvestment that resulted from the housing boom is revealed by developments in the Wilshire 5000 Total Market Index (Figure 20). This index tracks the total dollar value of all U.S.-headquartered equity securities with readily available price data. It includes more than 6,000 firms and, as such, it is a good proxy for capital accumulation in the U.S.14

Figure 20.

After reaching a high of $15.5 trillion in 2007, the index collapsed and fell to a low of $8 trillion in early 2009. As I write this, the Wilshire 5000 has been fluctuating around $12 trillion, a level it first reached in 1999. This implies that there has been no net capital accumulation in the U.S. economy since 1999. The capital that has been accumulated since then has either been consumed or wasted in misdirected investments. But it may happen that even the current level of wealth and income is based on false calculations, because the Fed has used every tool at its disposal and has even forged new ones in order to prop up housing and financial asset prices. The weak and tenuous recovery that the U.S. is now experiencing may well be a reflection of the depth of capital consumption and impoverishment that the U.S. economy has suffered as a result of the inflation-targeting policy of the past two decades.

6. A NOTE ON “SECONDARY DEFLATION”

The ABCT, when correctly formulated, does indeed explain the asymmetry between the boom and bust phases of the business cycle. The malinvestment and overconsumption that occur during the inflationary boom cause a shattering of the production structure that accounts for the pervasive unemployment and impoverishment that is observed during the recession. Before recovery can begin, the production structure must be painstakingly pieced back together again in a new pattern, because the intertemporal preferences of consumers have changed dramatically due to the redistribution and losses of income and wealth incurred during the inflation. This of course takes time.

In addition, the recession-adjustment process is further prolonged by the fact that the boom has wreaked havoc with monetary calculation, the very moorings of the market economy. Entrepreneurs have discovered that their spectacular successes during the boom were merely a prelude to a sudden and profound failure of their forecasts and calculations to be realized. Until they have regained confidence in their forecasting abilities and in the reliability of economic calculation they will be understandably averse to initiating risky ventures even if they appear profitable. But if the market is permitted to work, this entrepreneurial malaise cures itself as the restriction of demand for factors of production drives down wages and other costs of production relative to anticipated product prices. The “natural interest rate,” i.e., the rate of return on investment in the structure of production, thus increases to the point where entrepreneurs are enticed to renew their investment activities and initiate the adjustment process. Success feeds on itself, entrepreneurs’ spirits rise, and the recovery gains momentum.15

The rise in the natural interest rate that overcomes the pandemic demoralization among capitalists and entrepreneurs and sparks the recovery is reflected in the credit markets. For recovery to begin again, there needs to be a steep rise in the “real,” or inflation-adjusted, interest rate observed in financial markets. High interest rates do not stifle the recovery but are the sure sign that the readjustment of relative prices required to realign the production structure with economic reality is proceeding apace. The mislabeled “secondary deflation,” whether or not it is accompanied by an incidental monetary contraction, is thus an integral part of the adjustment process. It is the prerequisite for the renewal of entrepreneurial boldness and the restoration of confidence in monetary calculation. Decisions by banks and capitalist-entrepreneurs to temporarily hold rather than lend or invest a portion of accumulated savings in employing the factors of production and the corresponding rise of the loan and natural rates above some estimated “true” time preference rate does not impede but speeds up the recovery. This implies, of course, that any political attempt to arrest or reverse the decline in factor and asset prices through monetary manipulations or fiscal stimulus programs will retard or derail the recession-adjustment process.

Figure 21.

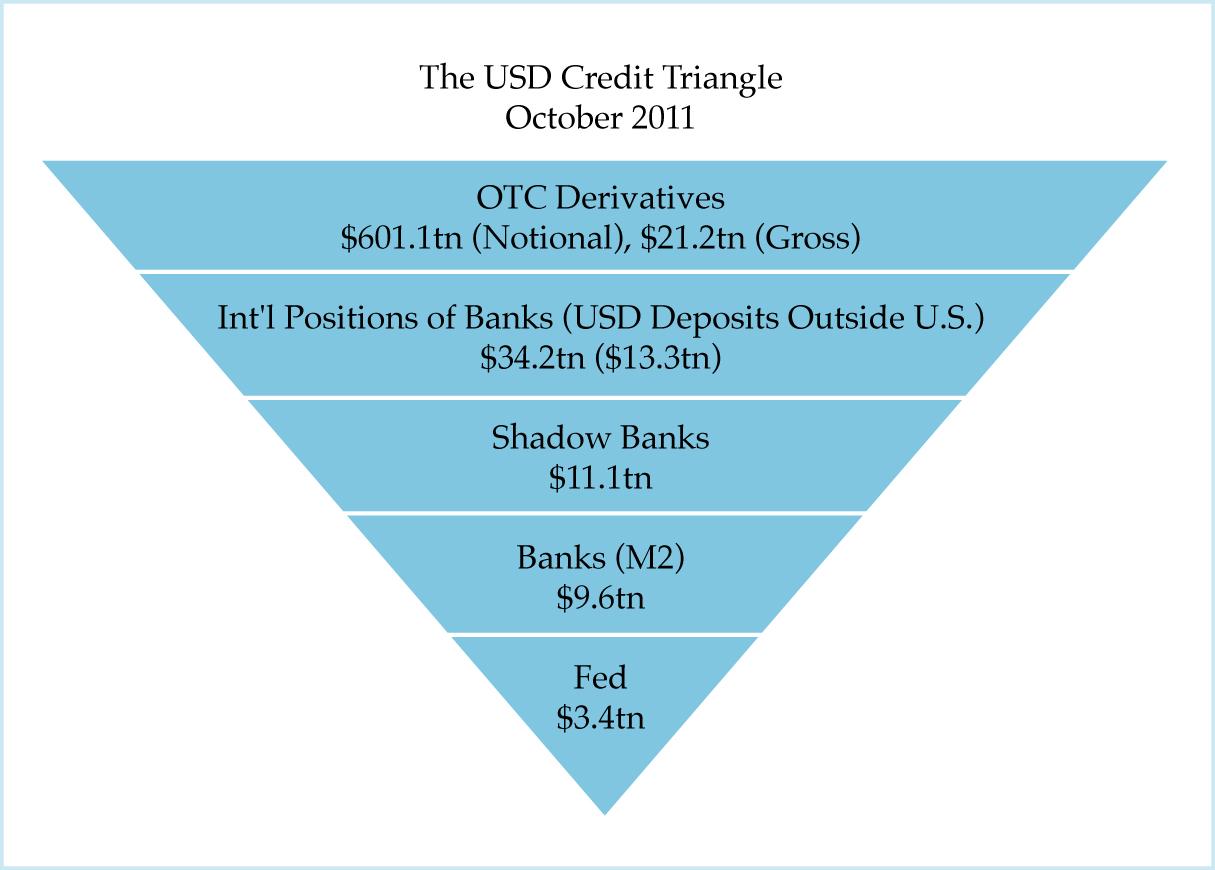

Figure 21 reveals the extent to which the Fed’s policy response has failed to revive the economy and has prolonged the “secondary deflation.” From August 2008 to June 2010 the Fed more than doubled its balance sheet and M2 increased by more than 10 percent. And yet, during the same period, there was substantial shrinkage of the upper tiers of the U.S. credit triangle, comprising credit extended by nonbank financial institutions and financial markets.16 Figure 22 shows an updated version of the triangle as of October 2011.17 Note that two of the three upper layers of the triangle, which are governed primarily by the expectations and decisions of capitalists and entrepreneurs, have continued to shrink despite the fact that the Fed has continued to increase its balance sheet and M2, by 78.9 percent and 11.6 percent respectively. This continuing fall in the credit portion of the triangle goes hand in hand with the weak and tenuous recovery that the U.S. economy is currently undergoing. Both are caused by the failure of the prices of assets, goods and labor services to adjust to economic reality and the concomitant lack of confidence in investment prospects by capitalist-entrepreneurs operating under the extreme relative-price distortion and regime uncertainty imposed by U.S. monetary, fiscal and regulatory policies.

Figure 22.

7. CONCLUSION

Once we understand the ABCT as a theory of the destruction and renewal of both the capital structure and monetary calculation, we are in a position to fully account for the events of the past decade. Furthermore, given the unprecedented monetary interventions by the Fed and the enormous deficits run by the Obama administration, ABCT also explains the precarious nature of the current recovery and the growing probability that the U.S economy is headed for a 1970s-style stagflation.

- 3Although Haberler was initially a supporter of ABCT, by 1933 he had become a critic of the theory and in his later career migrated to the position of moderate establishment Keynesian, although his writings still evinced his early Austrian orientation. For evidence of Haberler’s intellectual migration and lingering traces of his Austrian training, see Haberler (1933, p. 99; 1974; 1996); Ebeling (2000) and Salerno (2005).

- 4Although several criticisms are aimed at his argument below, they do not diminish the significance of Garrison’s achievement in drawing the attention of contemporary economists to the overconsumption effect in ABCT.

- 5All data on retail sales and consumption are drawn from this source unless otherwise noted.

- 6The data for the retail sales series prior to 1992 is not strictly comparable to the data on retail sales and food services from 1992 to the present since the former are on an SIC (Standard Industrial Classification basis and the latter on an NAICS (North American Industry Classification System) basis. See Federal Reserve Bank of St. Louis (2010a), p. 12; and also U.S. Census Bureau (2010).

- 7See Barbaro (2008), Baertlein (2009), Farfan (2009), Zarrello (2009).

- 8Note that for DeLong capital investment is limited directly by psychological attitudes towards risk rather than by concrete acts of saving, as if the material resources required for capital formation could be simply conjured out of the ether.

- 9The appendix is a response to a critique by Alvin Hansen and H. Tout of the first edition of Prices and Production. Hayek’s analysis of overconsumption does not appear in the original text of the book. This may account for the fact that even Austrian economists have misinterpreted Hayek on this point.

- 10In fact, Hayek published an important but neglected article on “Capital Consumption” in 1932. Although the article discussed the phenomenon in the context of nonmonetary government interventions, Hayek (1984, pp. 156–157, n. 2) recognized the link between capital consumption and the business cycle in a footnote, although at this point he only noted its relevance to “the later stages of a depression.” However, this article was published two years before the article that was included as an appendix to the second edition of Prices and Production cited above.

- 11Indeed, Mises (1998, p. 525) explicitly denied that the interest rate was an inducement to save: People do not save and accumulate capital because there is interest. Interest is neither the impetus to saving nor the reward or compensation granted for abstaining from consumption. It is the ratio in the mutual valuation of present goods against future goods.

- 12The last is not a completely hypothetical example. See Gaudin (2010), Khanduja (2010), Daily Mail Reporter (2010).

- 13For a full explanation of why the monetary expansion affected the housing market first and most intensely, see Woods (2009), Taylor (2009), and Jablecki and Machaj (2009).

- 14Fed economists have used the Wilshire 5000 to project changes in household net worth (Blackstone, 2009).

- 15According to ABCT as described above, the typically volatile fluctuations of entrepreneurial confidence and expectations over the business cycle are not purely exogenous psychological phenomena that economic theory must take as given. Rather, they are a rational response to the calculational chaos created by an incoherent monetary regime whose arbitrary manipulation of the interest rate systematically falsifies entrepreneurial estimates of the scarcity of capital. It is important to emphasize this point in order to sharply distinguish ABCT from recent Keynes-like psychologistic theories that seek to explain bubbles, crises and depressions by “animal spirits,” a term which refers to a witch’s brew of various noneconomic motives and irrational behavioral propensities of private economic decisions (see, for example, Akerlof and Shiller [2009]).

- 16The U.S. credit triangle was formulated and calculated by Steve Hanke (2010).

- 17This updated representation of the USD credit triangle was constructed for the author by Matt McCaffrey. The author is indebted to Steve Hanke for kindly providing data sources and a description of the methods used to construct the original triangles in Figure 21.