The Federal Reserve’s FOMC slashed the target federal funds rate at its meeting this month, reducing the target rate by 50 basis points from 5.5 percent to 5.0 percent. This was the largest cut to the target rate since March of 2020 in the midst of the Covid Panic.

This cut comes after fourteen months of the FOMC holding the target rate at 5.5 percent. In late 2022, the FOMC was forced to allow interest rates to rise in response to mounting price inflation which hit a year-over-year growth rate of 8.9 percent in June 2022. Since the official CPI inflation rate fell back below five percent in Spring of 2023, however, there has been continuing speculation about a “Fed pivot” in which the Fed will once again begin a cycle of cuts to the target interest rate.

This pivot finally came today, and more cuts are expected. According to the FOMC’s Summary of Economic Projections, most FOMC members report they believe the “appropriate target level” for the Federal funds rate will come in below 5.0 percent for 2024. This strongly suggests we should expect more rate cuts by the end of the year.

This is all a clear signal that the Fed and FOMC believe the economic situation is worsening. For political reasons, however, Fed Chairman Jerome Powell continues to insist that this month’s big cut to the target rate is definitely, totally not in reaction to worsening economic data.

During the post-FOMC press conference today, Fed Chaiman Jerome Powell repeatedly tried to take an upbeat tone about the state of the US economy explicitly stating—in his own words—”the US economy is in great shape” and “the labor market is in solid condition.”

Yet, if one looks closely, one will not find a case of the FOMC slashing the target interest rate by 50 basis points when the economy “is in great shape.” On the contrary, a 50 bps (or larger) cut to the target rate tends to come just a few months before recession and a rising unemployment rate. If one looks only at the unemployment rate in these cases, one could see how the economy might look decent even when the Fed starts a rate-cutting cycle. Over the last thirty years, 50-basis-point panic cuts come when the unemployment rate is barely up from recent lows:

But, unemployment rates inevitably rise after the rate-cutting cycle begins. For example, we see rate-cutting cycles begin in the late 1980s, in 2001, and in 2007. All precede recessions by a year or less. Moreover, the Great Recession, which began in December of 2007, was preceded by a 50 bps cut just a few months earlier, in September of that year. A year after that the unemployment rate was 6.5 percent, and peaked at 9.9 percent in early 2010.

In spite of all this Powell stated today that thanks to this rate cut he expects the economy to “expand at a solid pace.” Yet this prediction runs contrary to the data coming out of member Fed banks. For example, in the August Beige Book, only three of twelve Fed districts reported any economic growth at all. Dallas, Boston, and Chicago reported their economies “expanded modestly” or “increased slightly.” Five of the Fed districts reported economic activity “fell,” “contracted,” or “declined slightly.” All other districts said the economy was flat.

This sort of language in a Beige Book is remarkable, however, because Fed publications of this sort always err on the side of downplaying any economic distress. The economic situation has to be pretty bleak before we’ll see the Fed banks report an economic situation worse than “moderate growth.” (Indeed, while many economists were predicting only a 25 bps cut to the target rate, Bloomberg’s Anna Wong predicted a 50-point cut based largely on Beige-Book pessimism.)

The FOMC would have you believe that this round of rate cuts won’t be like all the rest, and today 50-point cut is merely a calm and collected effort to steer the US economy to a soft landing. If this plays out this way, it will be the first time in Fed history.

It’s impossible to know what Powell and the FOMC members really think of the economy, of course, because they have to say that everything is fine for political reasons. The Fed absolutely never comes out and says “yes, folks, we think recession will be here in a few months. Get ready” It should be remembered that in Spring of 2008, Ben Bernanke was still confidently claiming that there was not even a recession on the horizon—even though the recession had begun in late 2007.

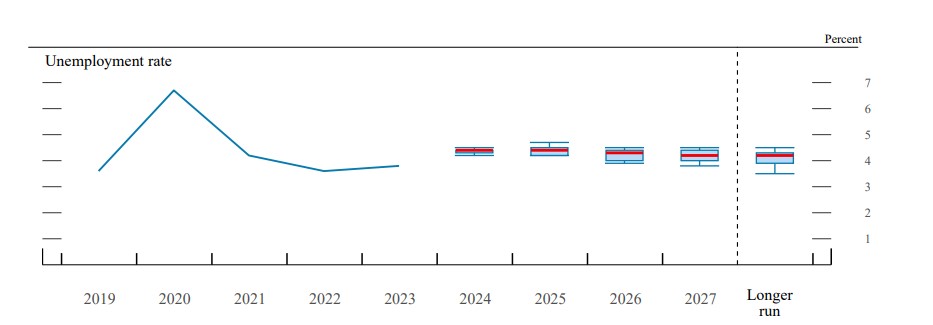

This time, true to form, FOMC members, in the Summary of Economic Projections, predicted that the unemployment rate will be flat or falling from now until at least 2027. These predictions run counter to virtually everything we know about how rising unemployment rates tend to follow—although are not caused by—rate cuts.

Even many of the reporters in the room during Powell press conference knew this. In fact, one of the more courageous reporters at the meeting asked Powell why he seems to think that the FOMC’s rate cut will this time be followed by sustained, low unemployment rates. In other words, she essentially asked “explain to us why this time is different.” Powell provided no answer except to mumble in a variety of different ways that the economy is doing well.

Given the timing of this cut to the target rate—that is, a few weeks before a national election—Powell clearly felt he needed to justify the move as not being politically motivated. After all, if the economy is so “great” and “solid” why is the FOMC cutting rates at all?

More astute observers already know: the Fed only makes big 50-point rate cuts when it fears substantial job losses. Job losses are a political problem. The reason the Fed otherwise doesn’t make such large cuts to the target interest rate is because cuts to the target rate are inflationary and price inflation is also a political problem. Thus, where the Fed comes down on rate cuts tells us what which the Fed believes is more of a political problem at any given time: the Fed cuts when it fears job losses and recession more. The slowing economy will then be disinflationary and the Fed doesn’t have to worry about price inflation.

On the other hand, if the Fed holds steady, or allows rates to rise, then it fears price inflation more.

These are political considerations. The Fed is not in the business of optimizing economic performance, and it certainly has no way of centrally planning the economy in a way that can ensure this happens. Rather, the Fed exists to ensure liquidity and cheap loans for the central government while also ensuring a non-stop flow of easy money for the banker class.

The Fed never admits this, of course. Powell framed the rate cut as designed to ensure the current “great” economy continues. When asked about what data any future rate cuts might be based on, Powell offered the usual, stock explanation of how the Fed is data-driven and looks only at jobs data and economic activity. But, he was then sure to say “we don’t look for anything else” while trying to sound casual. What he means was the Fed doesn’t consider any political information in its decision-making.

He then went on to say “everything we do is in service to our public mission” and that the Fed is strictly committed to “the people that we serve,” by which he presumably meant the American public.

Overall, today’s press conference was shocking in just how unconvincing Powell was. Apparently, Powell and his fellow Fed technocrats really do think it’s perfectly plausible to slice the Federal Funds rate and then also claim that the economy is doing very well. Powell and the other FOMC members apparently believe there is nothing at all implausible about FOMC members insisting that the unemployment rate will remain virtually unchanged around 4.3 percent for the next three years.

The Fed is desperate for you to think that “this time is different.” Unfortunately, Powell can’t seem to come up with explanation of why that is the case.

Here’s a shorter, video version of this article:

This week, the Fed hit the panic button and slashed the fed funds rate by 50 bps. History shows the Fed does this right before a recession, and Powell can’t explain why “this time is different.” More here with graphs: https://t.co/2B7WS2HMC4 pic.twitter.com/n3dXSYKaO7

— Ryan McMaken (@ryanmcmaken) September 19, 2024